Call or Put Kya Hota Hai? Options Trading Explained

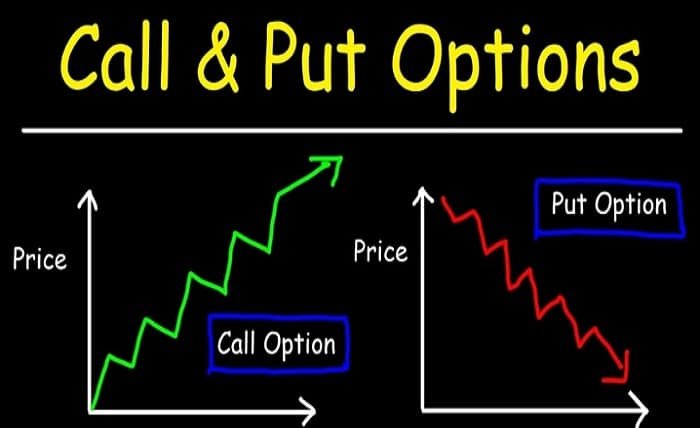

“Call or put kya hota hai?” is a common question among those new to financial markets and options trading. In simple terms, call and put are two types of options contracts used in the stock market for trading. These instruments allow traders to speculate on the price movements of an underlying asset or hedge their investments.

Understanding “call or put kya hota hai” is essential for anyone looking to venture into options trading. This blog will break down the basics, types, strategies, and benefits of call and put options in a simple and detailed manner.

Call Option Kya Hota Hai?

“Call option kya hota hai?” Let’s start with the basics. A call option is a financial contract that gives the buyer the right, but not the obligation, to purchase an underlying asset at a specified price (strike price) within a set time frame.

If the price of the asset rises above the strike price, the buyer can exercise the option to make a profit. For instance, if you believe the price of a stock will increase, you buy a call option to capitalize on that price movement. Understanding call options is key to grasping the essence of “call or put kya hota hai.”

Put Option Kya Hota Hai?

“Put option kya hota hai?” Like the call option, a put option is also a contract, but it gives the buyer the right to sell the underlying asset at the strike price within a specific period.

This type of option is beneficial if you believe the price of the underlying asset will decrease. For example, if you predict a stock’s price will fall, you buy a put option to potentially profit from the decline. Learning the differences between these two options is crucial for understanding “call or put kya hota hai.”

Call or Put Options Ke Fayde

To answer “call or put kya hota hai?” fully, it’s important to explore the benefits of these options. Here are some advantages of trading call and put options:

- Leverage: You can control a larger position with a smaller investment compared to buying the underlying asset.

- Risk Management: Options can act as a hedge against adverse price movements.

- Flexibility: You can trade in both rising and falling markets.

- Limited Risk: The maximum loss is limited to the premium paid for the option.

- Speculation Opportunities: Options allow traders to bet on market directions without owning the asset.

Understanding these benefits is essential to grasp the full scope of “call or put kya hota hai.”

Call or Put Kaise Kaam Karte Hain?

Understanding “call or put kya hota hai” also involves knowing how these contracts work in practice. Here’s a step-by-step explanation:

- Premium Payment: When buying a call or put option, the buyer pays a premium to the seller for the contract.

- Strike Price: The predetermined price at which the asset can be bought (call) or sold (put).

- Expiration Date: The date by which the option must be exercised.

- Intrinsic Value: The profit the option holder would make if the option were exercised immediately.

- Time Decay: As the expiration date nears, the option’s value may decrease due to the diminishing time left.

These mechanics are integral to understanding “call or put kya hota hai” and how they function in real markets.

Call or Put Ke Liye Strategies

To succeed in options trading, understanding strategies is as important as knowing “call or put kya hota hai.” Here are some popular strategies:

- Covered Call: Selling a call option against owned shares to generate income.

- Protective Put: Buying a put option to protect against potential losses in a long position.

- Straddle: Simultaneously buying a call and put option to profit from significant price movements.

- Iron Condor: A strategy to benefit from low volatility by selling options at different strike prices.

Using these strategies effectively can help traders maximize profits and minimize risks while trading options.

Risks Associated with Call or Put Options

While exploring “call or put kya hota hai,” it’s important to address the risks involved:

- Limited Lifespan: Options have an expiration date, after which they become worthless.

- Market Volatility: Sudden market changes can lead to significant losses.

- Complexity: Options trading requires a good understanding of the market and strategies.

- Premium Loss: If the market doesn’t move as predicted, the premium paid can be lost.

Understanding these risks is crucial to making informed decisions and managing investments effectively.

Conclusion

In conclusion, “call or put kya hota hai” refers to two essential options contracts used in trading and investment strategies. A call option allows you to buy an asset, while a put option enables you to sell it. These tools provide leverage, risk management, and opportunities to profit in various market conditions.

Understanding “call or put kya hota hai” is the first step towards mastering options trading. By learning their mechanics, benefits, strategies, and risks, you can make more informed investment decisions and potentially achieve better financial outcomes.

FAQs

1. Call or put kya hota hai?

Call or put refers to two types of options contracts: a call option gives the right to buy, and a put option gives the right to sell an asset.

2. Call or put options kaise kaam karte hain?

Call and put options work by allowing traders to speculate on price movements or hedge investments through contracts with specific terms.

3. Call or put options ka fayda kya hai?

Benefits include leverage, limited risk, flexibility, and the ability to profit in rising or falling markets.

4. Call or put options kaise trade karte hain?

To trade, you select the desired option type, determine the strike price and expiration date, and pay a premium to the seller.

5. Call or put options risky kyun hote hain?

Options are risky due to their limited lifespan, market volatility, complexity, and the potential to lose the premium paid.