Numbers with a Brain: How the Financial Dashboard Got Smarter Over Time

The financial dashboard used to be just a screen displaying numbers, totals, and charts that were pretty but did not do much more than tell us what had already occurred. As time went by, this tool evolved significantly. The financial dashboard today is a smarter and more valuable method for companies to make decisions. Today’s financial dashboard is not primarily concerned with reporting facts. It assists individuals to plan, predict, and act. This transition from age-old reports to intelligent, real-time insights is worth learning because it illustrates how companies today utilize data to develop and thrive amidst rapid change.

- From Printed Reports to Early Dashboards: Businesses used to depend on print reports to comprehend their financial status. These were hand-assembled and required time to prepare. Usually, by the time the report was done, the information was already out of date. Decisions were made on historical numbers, not current trends. When the first computerized dashboards arrived, they moved everything onto a screen but still displayed static information. Those early dashboards were a little better than paper but not much faster or more in-depth than what businesses required.

- Digital Dashboards Enter the Scene: As computers found their way into offices, dashboards gradually transferred to software programs. They were quicker to gather information and present it in tidy tables and graphs. But even then, dashboards were nothing more than a means of reviewing data on what had occurred. They were unable to forecast, recommend, or adapt in the face of things yet to occur. Companies employed them for review purposes in meetings and budgeting sessions.

- Rise of Real-Time Data Integration: The biggest transformation occurred when dashboards began to be updated in real time. With cloud computing and quicker internet, financial information could be drawn from numerous sources the moment it was input. This left decision-makers with the option of viewing what was occurring at the present moment, rather than looking at a week-old report. This provided businesses with a competitive advantage in high-paced businesses, where a few hours’ delay could cause a loss.

- Smart Dashboards and Automation: Presently, the financial dashboard is not merely a location to glance at numbers. It is an active system that interacts with automation. When cash flow falls below a threshold, alerts are issued. When expenses spike unexpectedly, a warning is issued. This is time-saving and prevents surprises. These dashboards today employ smart rules, utilizing past trends to predict what will happen next. They can even assist with making a prediction for sales, expenses, or profits using automated models.

- Introducing Artificial Intelligence into Action: There was another step ahead with artificial intelligence. AI-rendered dashboards are more than mere response tools. They became tools capable of learning. They can analyze spending patterns, identify suspicious entries, or even make educated predictions on future risks. If a company tends to spend more in one season of the year, for instance, the dashboard can alert the team in advance. If there is an error discovered in the figures, the system can flag it and even correct it at times.

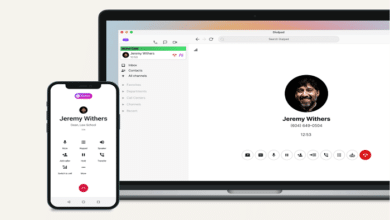

- The Role of Cloud-Based Platforms: Another massive reason why contemporary dashboards have succeeded is cloud technology. Previously, dashboards needed to be installed on office computers and required updates periodically. Today, cloud-based tools are continually updated and can be accessed remotely. That is, the leaders and the workforce can view data while in transit or at home working. Companies can continue to expand without fear of storage or technical constraints. The cloud enables joining various data sources and tools seamlessly, making the dashboard wiser and more comprehensive.

- Better Design and Visual Storytelling: Bright colors, simple charts, and color indicators help users spot issues or trends in an instant. A well-crafted financial dashboard does more than display data—it tells a narrative. If profits are declining, the hue is changed. If sales increase, a chart indicates the rise. These basic but intelligent features allow even a novice user to grasp complicated numbers. This facilitates instant and easy decisions.

- Assisting Small Enterprises and Entrepreneurs: Earlier, only large companies could manage intelligent dashboards. However, now even small enterprises and entrepreneurs utilize them. The software has become less expensive and simpler to manage. A small business owner can monitor daily expenses and revenues. A startup entrepreneur can track investor money, team expenses, and customer payments. This has brought more fairness and transparency to financial planning. Small competitors can now compete more effectively, as they too can tap into the information previously available only to large corporations.

- Integrating with Other Business Applications: Today’s financial dashboards are not standalone. They are integrated with sales applications, customer support platforms, and inventory trackers. This integration makes data more robust. A sudden increase in sales will appear alongside increasing product demand or complaints from customers. A decrease in profits will be associated with delays in deliveries. The combination of information informs businesses what is actually happening. It enables quicker action and improved planning. Teams are now able to fix issues before they become bigger.

- The Role of Customization and Flexibility: An up-to-date dashboard can be tailored to fit the user. Various users get different views based on their role. A finance officer may view cost reports, but a project manager gets budget usage. Such a custom view makes things less cluttered and centered. It also implies that businesses do not have to conform to a set design—they are able to tailor the dashboard to their requirements. Such an approach makes the dashboard even more useful and less confusing.

- Deciding Better More Quickly: One of the biggest strengths of today’s financial dashboard is speed. Decisions that once took days can now be made in hours or minutes. This is because the data is fresh, the insights are clear, and the system suggests the next step. Managers don’t need to wait for a report—they already have what they need. This helps in beating competitors, solving problems early, and grabbing new chances as soon as they come.

In conclusion, the financial dashboard has evolved a lot. From a simple report that displays historical figures, it has evolved to be an intelligent system that can learn, counsel, and assist in real-time decision-making. It assists each and every team, large or small, to plan better and act quickly. With technology continuing to progress, the financial dashboard is sure to get even more potent, easy to use, and vital in each business journey.